In Germany (almost) nothing works without a tax identification number (IdNr): The eleven-digit identification number issued by the Federal Central Tax Office (Bundeszentralamt für Steuern, BZSt) is needed for the salary slip at work as well as for applying for child benefit or care allowance. You also need it to open a bank account or register a car. The job centre also asks for the IdNR, which is often colloquially called the tax ID.

The tax ID is valid for life and does not change even if you move or get married. This can be found on the homepage of the Federal Central Tax Office. The tax ID number is not identical to the tax number that is currently issued additionally by the tax offices. That is why many people have a tax number in addition to their tax ID. The tax number is issued automatically, including when a child is born or when a person moves to Germany. Migrants who register with the authorities are automatically sent the tax ID by post.

https://www.bzst.de/DE/Privatpersonen/SteuerlicheIdentifikationsnummer/steuerlicheidentifikationsnummer_node.html

On a special page, refugees from Ukraine can also access the information in Ukrainian:

https://www.bzst.de/DE/Privatpersonen/SteuerlicheIdentifikationsnummer/steuerlicheidentifikationsnummer_node.html#js-toc-entry1

Those who lose their identification number can request a duplicate via the Federal Central Office. There is a special link for this:

https://www.bzst.de/SiteGlobals/Kontaktformulare/DE/Steuerliche_IDNr/Mitteilung_IdNr/mitteilung_IdNr_node.html?fbclid=IwAR0bg3Ee2TjBzaX9_Pzms_-FSJS4_ymrz91LorE813rjz-m-hMlKcR8HEMM

tun23083002

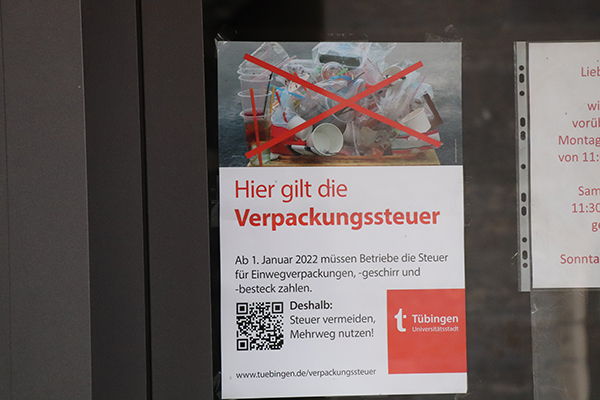

Verpackungssteuer in Tübingen. Foto: tünews INTERNATIONAL / Mostafa Elysian.

001657